On Thursday, September 7th, Spencer Styles, President and CEO of Charter Impact and Bonnie Bensen, CFO at Fortune School of Education, joined our President and CEO at Charter School Capital, Stuart Ellis, to discuss budget planning best practices for California charter schools.

There are many challenges involved in operating schools including planning and maintaining school budgets, navigating staggered charter school funding timelines and managing complex cash-flow systems. Our speakers offered best practices for charter school budget planning steps tailored to your school’s stage of growth and also covered budget specifics for California.

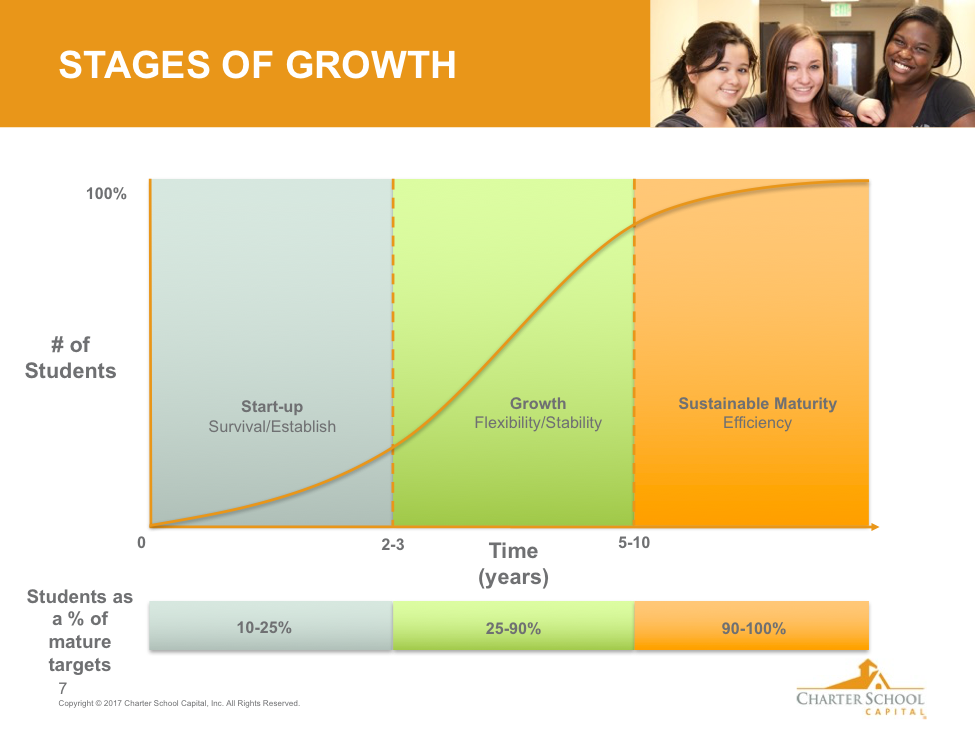

In the three phases of the school growth cycle, the start-up phase involves getting the schools up and running and requires different strategies than any other stage in the lifecycle of the school.

“This [stage] lasts from year zero, when you get your charter, to years two through three. If you’re successful at surviving the start-up phase, which is exceedingly challenging, you get into the area of opportunity that we’re referring to as the growth phase,” explained Stuart Ellis. “During your mature phase (year five or so), you’ll focus on being as efficient as possible so that you can invest more funds and resources back into making the program better and better over time.”

The early challenges in this phase start with getting operational support, which is typically more difficult than expected.

“Newer charter school leaders tend to come from an educational background and have a vision of how to create and ensure community involvement. Yet many people don’t realize that your financial structure goes through the same kind of growth and change as the instructional program itself,” according to Spencer Styles.

“You might have a visionary leader who has a wonderful idea for an academic program, but they don’t really understand the actual business of running a charter school. So it’s really important to get someone on your team, whether it’s an in-house or external person, that can help give you that financial expertise,” added Bonnie Bensen. “Authorizers often cite this as the reason for not approving a charter in the first place, because they don’t meet the criteria for a sound financial plan.”

When looking at creating your school’s financial structure, funding is one of the things you’ll need to plan for. There are many financial programs available in California that schools can tap into, including these options:

- Access to grants, fundraising, and charitable contributions (this is a key aspect of what organizations do to get going)

- Revolving loan from CDE serve schools in their first three years – $250K is available directly from the state at a very low cost

- Receivable sales – a program that Charter School Capital and other organizations have engaged in, and available at all growth stages

- Long-term lease as a way to give 100% financing for facilities (available at all growth stages)

- Line of credit from a traditional bank or financial institution where the bond market is not typically available (best for schools in startup phase)

- Bond market (typically only available to schools in the maturity phase, after facilities and operations have been fully funded, because it has many restrictions that restrain the growth of a school in startup mode)

The primary reason the start-up phase is so difficult for schools is that every single area of the organization is scrutinized. The recruitment process for both new staff and students takes up a lot of time and energy. A lot of attention must be given to budget and cash flow in the first year because the timing of payments from the state of California is unusual, typically not coming in October after the school year has started. Financial planning is crucial for many reasons, one being that new schools often have a hard time determining needs versus wants. In the first year of operations, schools will be limited to spending on what they need as opposed to things they want as they grow into sustainability.

Best practices recommended by Styles and Bensen in this phase include:

- Start with a petition budget

- Pay close attention to the budget and map to school priorities for the year

- Have a plan and show how costs frame the budget proposed

- Include all expenses – start with your wish list and then prioritize your budget

- Plan for potential surprises

- Build a budgeting process to follow annually

Challenges in the start-up phase often start with the recruitment process and trying to get student enrollment to meet petition targets – this takes up a lot of time and energy. A lot of attention must also be paid to cash and bank balances to account for the timing of California state payments to schools. School leaders also must focus refining and implementing instructional plans that were documented in the school petition, and hiring all staff.

“If you’re coming from a larger district or more formalized structure, a lot of new petitioners don’t realize that when you start your own charter, you are literally 100% on your own financially,” added Styles.

If a school is successful at surviving the start-up phase, it moves to the growth phase where schools have the most opportunity for rapid growth. Our Growth Estimator can help show the potential financial impact by calculating how much it will cost to expand and how much value will be added through expansion.

It’s important to also consider the facility implications when planning school growth. Charter school facilities have unique building requirements and these must be thoughtfully included in the plans for growth. For example, buildings must be structured a way that’s conducive to operating classrooms and have the space to add on grades as the school expands.

“It’s very disruptive to families to change the school site around. So, the best-case scenario is to find a location that you can be in long term,” said Bensen.

The best approach for tackling the growth phase is to take the best practices started in the start-up phase and refining them as you grow. Can your facility grow with you? What capital will it take for the facility to accommodate growth? What kind of growth am I aiming for – expansion or replication?

More best practices to consider in the growth phase:

- Start with previous year’s budget rather than estimating

- Have solid enrollment projections to build budget needs

- Active management of cash flow + 30-day forecasting (visibility into the finances is key for EDs/CEOs of schools)

- Understand your AP – some outstanding bills must be paid regularly while others can be negotiated at longer terms (vendor maintenance)

- Partner with external service providers or have an experienced team member dedicated to focus on your financials, or both

- “Have a solid plan for how you want to grow, stick to your vision, track your data for your enrollment and recruiting, and manage your cash,” advises Bensen.

Other challenges of operating in the growth phase include:

- Maintaining high expectations and being flexible

- Matching capital to operational needs

- Ensuring access to capital when needed

- Baseline budget

- Tie budgets to what is proposed – prioritize

- Managed growth – continued growth will allow more

At the sustainable maturity phase, your school is at maximum capacity with the number of students you plan to enroll. This is when school leaders really get to focus on some of the “wants” or the big vision they had in the start-up phase. But it does also bring its own set of challenges, including:

- Consistently request input from all stakeholders

- Opening schools in new states adds complexity

- Stay vigilant – state funding ebbs and flows. Keep the next downturn in the front of your mind and proactively prepare for it.

- State finances timing/flow

- Prepare for consistent turnover in technology to stay competitive

- Think ahead – repairs and replacement fund/preparing for deferred maintenance and major updates

Best practices in this phase are closely related to the challenges, especially those around targeting cash reserves, vendor management and planning around single year deficits. Others recommended by Styles and Bensen include:

- Strategic enrollment = stable growth

- Continually monitor process and budgeting

- Negotiate with and manage vendors to get the terms

- Negotiate with and manage vendors to get the terms that work best for the school

- Know your financial target benchmarks and manage to them

- Tap into working capital to extend available cash for growth

- Target cash reserve to cover any economic downturn

- Long term facility requirements and technology needs

- Single year deficits – know how to manager these deficit years when they arise (don’t depend on school growth)

“Financing tools in the market can also be useful to address some of these issues and ensure that you have cash reserves and a fund balance at year end, regardless of what happened from a deficit or surplus standpoint during an individual year,” added Ellis. “That said, the same point that’s being made is about managing your expenses conservatively. Using financing as a one-time boost is valuable but financing a one-time deficit doesn’t work.”

Our team is ready to walk you through our Growth Estimator based on your school’s needs. Reach out to us at GrowCharters@charterschoolcapital.com to schedule a one-on-one meeting with one of our team members.